How it works?

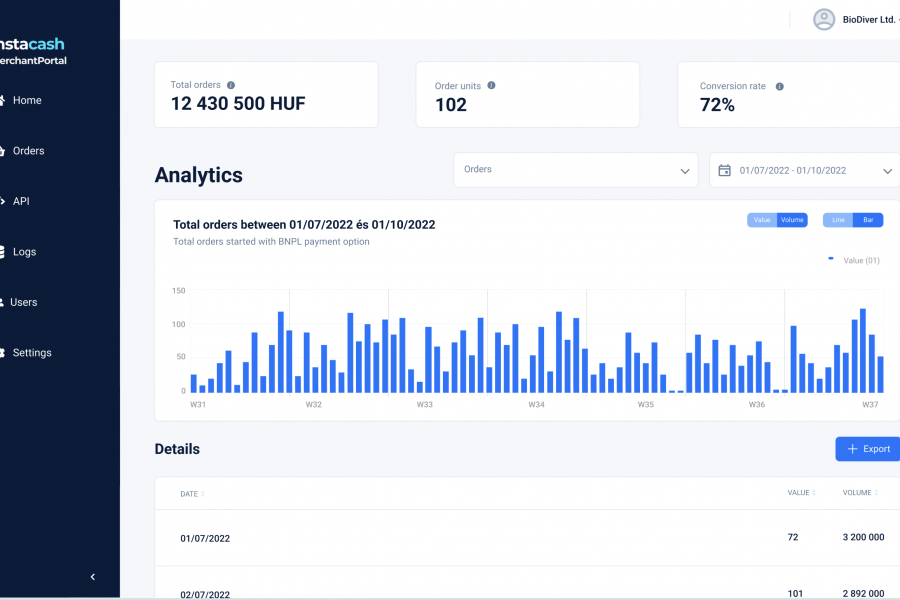

Our digital instalment scheme provides a complete solution for our merchants partners online or offline.

BNPL powered by instacash

About our solution

Process overview

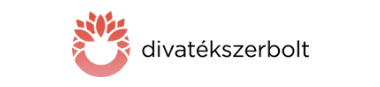

How does digital installment payment work?

1

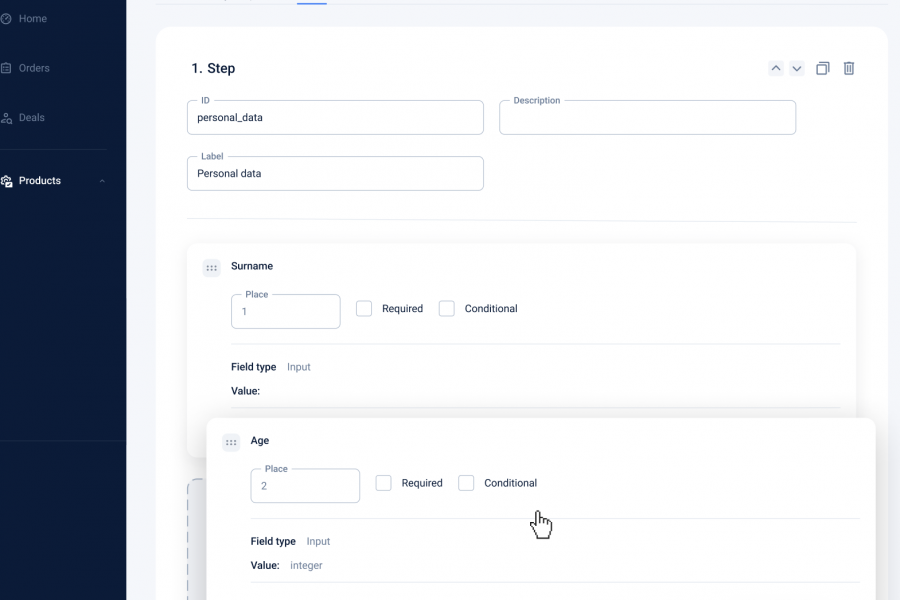

Digital Customer Identification

Only a mobile phone or laptop is needed for identification.

2

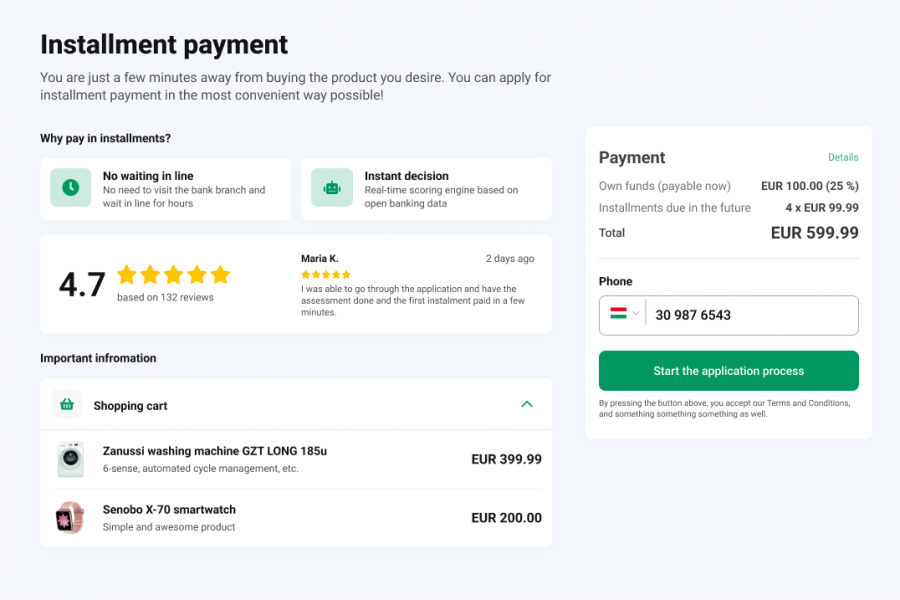

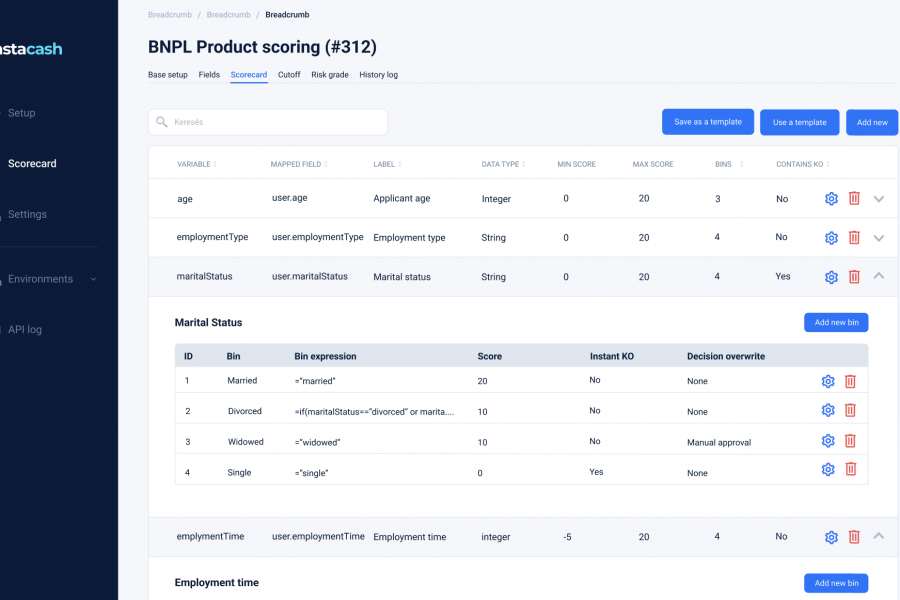

Automatic Customer Evaluation

Automated assessment in moments, with electronic bank account history sharing.

3

Digital Contract Signing

Online contract signing with a mobile phone in your pocket.

4

Automated Installment Payments

In the most convenient way possible.